Research

Selected publications

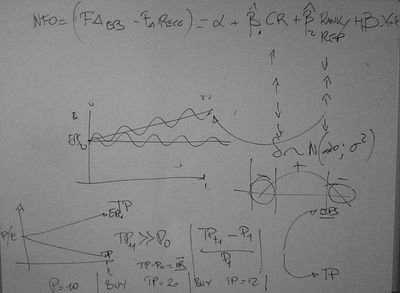

- Watching the FedWatch (with S. Huang and M. Simaan), The Journal of Futures Markets, forthcoming.

- (Im)perfect Substitutes: Business Angels and Crowd Sourced Start-up Funding. (with V. Capizzi; G. Giudici, F. Tenca), International Review of Economics and Finance, October 2025.

- Should Your Firm Have a Long-Tenured Independent Director? (with L. Enache, M. Ferrari, K. John, D. G. Ross), Harvard Business Review, December 2024.

- Buy the dip? (with M. Simaan, T. Shohfi), European Financial Management, September 2024

- Homophily and Merger Dynamics (with M. Vaidya) , British Journal of Management, June 2024

- Dual Holding and Bank Risk, (with A. Taatian), Financial Review, Winter 2023

- Long tenured independent directors and firm performance (with K. John, J. Deng, M. Ferrari, David G. Ross), January 2022, Strategic Management Journal.

- Board meetings dynamics (with V. Lagasio), January 2022, Corporate Governance: an International Review.

- Digitization in Finance (with F. Bertoni, M. Colombo, S. Manigart, M. Wright), Entreprenurship Theory and Practice, August 2021

- Gazelles, ponies, and the impact of business angels’ characteristics on firm growth. (with V.Capizzi; A. Croce; and E. Ughetto), Journal of Small Business Management, September 2020

- The performance of angel-backed companies, (with V. Capizzi, P. Zocchi), Journal of Banking and Finance, 21 (2-3), May 2019.

- The Role of Venture Capital in the Entrepreneurial Finance Ecosystem: Future Threats and Opportunities (with V. Capizzi). Venture Capital, 21 (2-3), May 2019.

- Emerging trends in entrepreneurial finance (with V. Capizzi, D. Cumming). Venture Capital, 21 (2-3), May 2019,

- Angel Network Affiliation and Business Angels’ Investment Practices (with V. Capizzi, P. Zocchi, M. Valletta). Journal of Corporate Finance, June 2018

- Credit Market Concentration, Relationship Lending and the Cost of Debt (with A. Dell'Acqua, M. Fungo, V. Kysucky), International Review of Financial Analysis, 2016

- Secondary Buy-Outs: operating performance and investment determinants, Financial Management, Winter 2015.

- A, B or C? Experimental tests of IPO mechanisms (With O. Voloshyna), 2013, European Financial Management

- The effects of Venture Capitalists on the Governance of firms (With S. Alkan, A. Salvi) 2012, Corporate Governance: an International Review

- Corporate Scandals and Capital Structure (with D. Boraschi), 2011, Journal of Business Ethics

- The Macro and Political Determinants of Venture Capital Investments around the World (with S. Alkan), 2011, Small Business Economics

- Target price accuracy in equity research, (With R. Bianchini, A. Salvi, L. Zanetti), 2010, Journal of Business, Finance and Accounting

Working papers

- Bond ownership and credit default swap coverage (with K. John, S. Banerjee and M. Vaidya, ), under review

- The Value of Data: Analysts vs Machine, under review (with G. Zhou, T. Shofi, and M. Simaan)

- Environmental Ethics, Financial Productivity, and Carbon Pricing, under review, (with M. Vaidya, S. Wu),

- Creditors inattention, risk taking and CEO latent characteristics: Evidence from CEO firing (with M. Vaidya)

- Private Equity Returns: Estimates from 50 Million Funds.

- Worker (Mis)Classification Laws and Entrepreneurship (with M. Awuni)

- Intangibles and the pricing of corporate bonds (with M. Vaidya)

- Equity reinvestment and sellers' myopia (with M. Lertora)

- Data as an asset: a Tobin’s Q decomposition (With M. Ferrari and I. Guttman)

- The pricing dynamics of continuation fund transactions (with M. Lertora)

- Dark Trading and the Exchanges Switches (with Filippo Pavesi, T, Bassetti, A. Taatian).

- Definitivity Avoidance as a Source of Informational Inefficiency, (with Filippo Pavesi, Thomas Bassetti, and Fausto Pacicco).

- What is the Value of Analysts research? (with S. Bharath,)

Book Chapters

- The role of angel syndicates on the demand and supply of informal venture capital (with V. Capizzi), 2019, in New Frontiers in Entrepreneurial Finance, World Scientific Publishing

- Institutional investors and corporate governance, in Handbook of Research on Entrepreneurship and Corporate Governance, Edward Elgar Press, 2016.

- The causes and financial consequences of corporate frauds (with D. Boraschi), 2012, in Entrepreneurship, Finance, Governance and Ethics, R. Cressy, D. J. Cumming, C. Mallin eds, Springer Press

- The development of Venture Capital. December 2011, in Handbook of Venture Capital and Private Equity, Douglas Cumming editor, Oxford University Press,

Other Publications

- Subjective valuation and target price accuracy(with Alexander Kerl, Giessen University). Journal of Financial Management, Markets and Institutions, June 2022.

- Does post-IPO M&A activity affect firms' profitability and survival? (with V. Capizzi, G, Giudici) Journal of Financial Management, Markets and Institutions, 1/2018

- Do firms hedge translation risk? (with M. Dallocchio, P. Raimbourg, A.Salvi), Journal of Financial Management, Markets and Institutions, 2/2016

- Testing Share Repurchases Hypotheses: a Conditional Study (With V. Capizzi, R. Mazzei), Corporate Ownership and Control, Vol. 5, n. 4, Summer 2008.

Research Awards

- October 2022: Financial Management Annual Conference, Best Paper Award (Finalist)

- October 2021: Financial Management Annual Conference, Best Paper Award (Runner-up)

- November 2019: Puebla Mexico, The Econometric Society American Conference, Honorable mention.

- June 2015: Amsterdam, EFMA Conference Best paper award (Runner-up)

- May 2014: Tokyo, FMA Conference Best paper award (Runner-up)

RESEARCH Coverage

Blog

- Harvard Law School Forum on Corporate Governance, June 2017 on Long Tenured Directors.

- Columbia Law School Blue Sky Blog, May 2017 on Long Tenured Directors.

Press

- Financial Times: multiple coverage on the Illumina buyout, 2023

- Financial Times: multiple coverage on the Twitter controversy, 2022

- WalletHub, interview on peer-to-peer lending, 2021

- CNN Business, interview on the fixed income market after the 2020 Presidential elections.

- Aftonbladet (Sweden), Norwegian Business Daily, coverage of article on Secondary buyouts December 2012.

- Fortune, coverage of article on Secondary buyouts, August 2012.

- Wall Street Journal, coverage of article on Secondary buyouts, October 2011.

- Il Mondo, Sarfatti 25: coverage of article on corporate scandals, 2011.

- Il Sole 24 ore, coverage of article on analyst target prices, 2008.

- L’espresso, coverage of article on analyst target prices, 2008.

- Il Mondo, coverage of article on analyst target prices, 2008.

- Il Corriere della Sera: coverage of article on analyst target prices, 2008.

- Il Sole 24 ore: roundtable with the CEO of Borsa Italiana and the president of AIAF on analyst accuracy and conflicts of interest, 2008.

TV

- AP: regular column capital markets, 2021-present

- Sky News columnist on inflation and FED policy 2022-presentCNBC Italy: invited speaker on conflict of interests in the investment banking industry, 2008.

- CNBC New York: invited speaker on the financial crisis, 2009.

- CNBC Italy: invited speaker on analyst forecasts and target prices. 2008.